Property Tax

The Jefferson County Sheriff’s Office is the primary property tax collector for state, metro, Louisville district, school, fire, and other special district taxes. We collect approximately 1 billion dollars per year, from over 300 thousand taxpayers, for 13 different taxing jurisdictions.

Important Tax Note

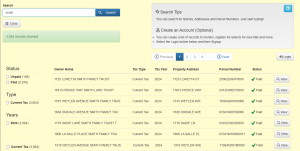

You can search your real estate taxes by Property ID, Owner Name or Property Address and personal property taxes by Business Tax Number or Business Name.

Tax Search

To View, Print or Pay Online, visit our Online Pay Portal

Tax Collection Dates

Collection of the 2025 bills will start November 1, 2025.

You can search your Real Estate Taxes by- Property ID

- Owner Name

- Property Address

- Business Tax Number

- Business Name

Online Payments Information

Once ready to check out you will be able to make payment of all parcels at one-time online either by eCheck or credit/debit card. Depending on the type of payment you select you will be charged the following convenience fees: eCheck Funds are automatically deducted from you bank account - pending verification of valid account information and availability of funds.

Flat Fee of $2.00 per transaction will be charged when paying with eCheck.

Credit or Debit Card Payments – American Express, Discover, Master Card and Visa.

A convenience fee of 2.25% of amount paid will be charged on card payments. For payments under $86.00, there will be a $1.95 minimum fee added to the total.

If you have tax questions, please call: (502) 574-5479.